Abstract

Understanding the success of regional entrepreneurial startup ecosystems is crucial for the advancement of local economies, job creation and growth. The current paper takes a unique theoretically focused look at common ecosystem elements that regional startup ecosystems may need to pay extra attention to in order to become as competitive as top-tier startup ecosystems. In our analysis, we compare two prominent models on elements of ecosystems: the Entrepreneurial Ecosystem Elements by Stam and van de Ven (2019 and the Entrepreneurial Ecosystem Diagnostic Toolkit (2013). We conclude this paper with drawing up eight propositions and an invitation for future empirical research to test these propositions in practice.

Keywords: regional startup ecosystems, entrepreneurial startup ecosystems, startups, top-tier, regional development

1. Introduction

Startups are a major force of economic growth worldwide, contributing in a sizable manner to national economies. For example, a recent report by the University of Southern California, Marshall School of Business ranked the United States, China, India, the UK and Singapore as the top 5 countries on share of billion-dollar startups (USC Marshall, 2020). Billion-dollar startups, a.k.a. “unicorns” are valued at $1 billion or higher. While these types of “unicorns” have been found to be able to disrupt high-stakes players and transform markets and traditional economic models (e.g., Amazon, Apple, Uber, Tesla all started off as startups), most startups can be small, yet successful. This is because what all startups – small and large – have in common is the ability to drive (regional) innovation, create new ideas and develop positive trends in regions with structural challenges and in addition drive the creation of new jobs (Bakker et al., 2019).

Another characteristic that successful startups share is belonging to an ecosystem where – just like living organisms – they can find the necessary resources to thrive. In the case of living organisms, these resources include water, food, and shelter from harm. In the case of startups, these resources include (Halbe & Koenraads, 2020): expertise (e.g., startup hubs and science parks), capital (e.g., public and private funds), support (e.g., accelerators and incubators), networks (e.g., collaboration events and competitions), and education (e.g., centers of entrepreneurship affiliated with universities and a strong teaching curriculum focused on entrepreneurship). A comprehensive discussion on the etymology of the term ecosystem has been provided by Cavallo et al. (2019), while also cautioning the reader that the biological metaphor has its boundaries (Roundy et al., 2017): biological ecosystems are simpler and survival driven, while our man-made business ecosystems tend to be more complex and reason driven.

A more recent discussion on the importance of startup ecosystems in contributing to a country’s economic growth has focused on entrepreneurial startup ecosystems (abbreviated to ESE’s). What makes ESE’s unique is a focus on the broader context and the relationships between startup entrepreneurs and a broad array of stakeholders in the region. It is of crucial importance that all stakeholders have a common goal, namely the creation of “aggregate welfare” for a city or region, through entrepreneurial activities (Stam & van de Ven, 2019).

Scholars are still discussing how to approach the study of ESE’s best. While there have been advancements on creating a definition (Cavallo et al., 2019; Stam & van de Ven, 2019) and identifying attributes and elements of ESE’s (Stam & Spigel, 2018; Stam & van de Ven, 2019), what is still largely absent from the discussion is a comparison and contrast between top-tier ESE’s (e.g. Silicon Valley, Berlin, Tel Aviv) and their smaller (but not necessarily lesser) counterparts. What we find worthy of a discussion is if the various attributes and elements of ESE’s are universally applicable to all ecosystems, despite their size and perceived economic success. We find having this discussion particularly relevant for several reasons. Firstly, because most regions are simply not top tier, in the sense that they do not enjoy the notoriety, location or seed accelerator options of big players such as Silicon Valley, Berlin or Tel Aviv (Hochberg & Fehder, 2015). In this sense, we propose adding the word regional to our above introduced term of entrepreneurial startup ecosystem to refer to these less popular and less acknowledged ecosystems that still can have the potential to become very successful (i.e., in terms of more economic impact, job creation, research and development). Secondly, because local conditions can largely vary and

evolve over time, which makes the idea of applying best practices from top-tier ecosystems very appealing. And thirdly, because often times ESE’s can be geographically close yet feel very distant due to country borders (Bakker et al., 2019) and thus fail to collaborate to potentially become a top-tier ESE.

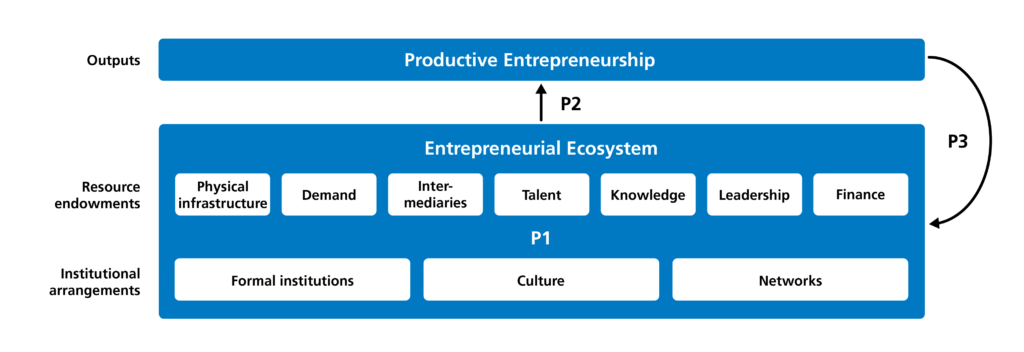

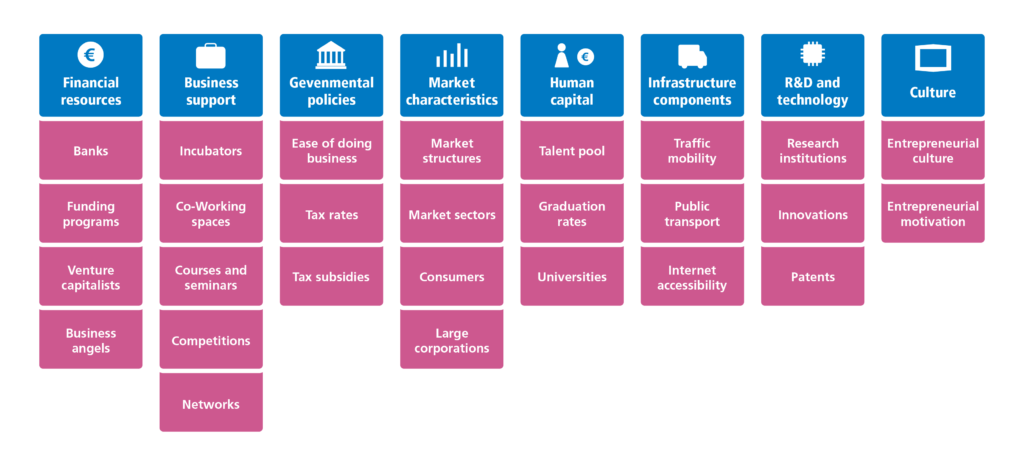

Our paper is structured as follows. We begin with analyzing present theoretical considerations on attributes and elements of ESE’s. We base our analysis mostly on the work of Stam and colleagues, distinguishing between resource endowments and institutional arrangements for a total of ten elements (Stam & van de Ven, 2019; see Figure 1), and the Entrepreneurial Ecosystem Diagnostic Toolkitlisting eight determinants of entrepreneurial ecosystems (ANDE, 2013; see Figure 2). We will also point out when overlaps exist between the two models, and which of the elements we consider to be same/different between top-tier and regional ecosystems.

By choosing these two models in particular, we are – on the one hand – answering the calls of Stam and van de Ven (2019) to validate and give feedback on this rather novel model. On the other hand, we are comparing it to the ANDE model which has been the result of refining nine previous framework on entrepreneurial ecosystems based on two criteria: geographic unit of analysis and complexity as a function of their elements. We then conclude with discussing future directions to gain a more precise, empirically rooted basis into the comparison of top-tier and regional ecosystems. To our knowledge, this discussion is still missing in the academic literature and we see this theoretical paper as an important first step in order to advance research on regional ecosystems’ further development and success.

2. Present Considerations

The first element we discuss is physical infrastructure (Stam & van de Ven, 2019) and infrastructure components (ANDE, 2013). Both models largely define this element as a composite measure of accessibility to the region, via motorway/railway access, air travel, as well as digital access (communication, mobile, internet). In addition, practical questions about the remoteness of an area, travel time to get there and health of its digital and power grid can be put forth. While the location of an ecosystem is usually fixed, it is possible to invest in the development of its infrastructure to make it more competitive and attractive for investors. For example, by building high-speed motor/railways for physical access and high-speed mobile networks like 5G for digital access. In this sense, we consider this element not a decisive factor between top-tier and smaller/regional ecosystems. This is because this is a condition that can evolve over time and work out in the advantage of smaller ecosystems. However, one note is worth making. According to Cukier (2016, as cited in Bala Subrahmanya, 2017), geographical distance and dimension should be limited to around 30 miles (equivalent to 48 kilometers or one-hour drive) within an ecosystem to maximize its potential.

The second element we discuss is that of formal institutions (Stam & van de Ven, 2019) that could best be compared to policy in the ANDE model. In a nutshell, it refers to the quality and efficacy of the government (at national, state and local level) and the general regulatory bodies within countries. With several indicators that exist to measure ease of doing business, corruption, government effectiveness and accountability (Charron, 2012), we consider these elements to have a large structural inertia and great impact on the success and development of ecosystems, large and small. (Structural inertia is defined by Robbins and Judge (2019) as an organizational source of resistance to change. In general, organizations and systems have built-in inertia to produce long-term stability. Indicators such as the Corruption Perception Index and Ease of Doing Business Index have shown that countries largely maintain their annual position on these respective rankings, thus our assumption of inertia.)

Another important factor next to ecosystem size would be the role of governments in creating solid regulatory frameworks and incentives for the private sector to engage in the ecosystem in the first place (Chohra, 2019). Stam and Spigel (2018) would refer to these as institutional, or framework conditions that can by definition enable or constrain success and, at this point, we assume these framework conditions to be equally impactful on all ecosystems. However, one assumption worth further empirical testing is that the larger and more influential individual players and ecosystems become (i.e. the most likely it is to become top-tier), the more leverage they could exert on policymakers and government institutions in a respective region. As an example, Tesla, with its only U.S. production site in Fremont, California (the larger San Francisco Bay area, a top-tier ecosystem) has recently threatened to move its factory to another U.S. state as a response to local authorities’ denial to allow early reopening during the COVID-19 crisis; this prompted immediate response from authorities and the willingness to compromise (DW, 2020).

Talent (Stam & van de Ven, 2019) is comparable to human capital (ANDE, 2019), generally measured with indicators such as quality of education in a region, number of universities and graduation rates, as well as overall age of the working population with a higher education degree. In general, the more universities and talented people are present in a region, the higher the chance for associated research centers, spin-off startups and economic and entrepreneurial success (Krajcik & Formanek, 2015). Therefore, we propose that top-tier ecosystems may have an advantage derived from name recognition. That is, university graduates could choose to find work or begin startups in these more attractive ecosystems (and not where they graduated) to the disadvantage of smaller and more regional ecosystems. This was an important issue also identified in a recent study that investigated two neighboring regional ecosystems in a border region between Germany and the Netherlands (Bakker et al, 2019). In this particular study, participants indicated they would rather work in a more cosmopolitan area further away than in the relatively smaller cities in these regional ecosystems.

As for the elements of demand (Stam & van de Ven, 2019) and markets (ANDE, 2013) we see a clear overlap, while mentioning that markets seem to be more broadly defined than demand. Namely, the main focus of demand is disposable income per capita and purchasing power of consumers, while markets additionally include elements of distribution, retail and marketing networks. Nevertheless, we – in line with Stam and van de Ven (2019) – would reason that bigger ecosystems may find it easier to cater for demand as compared to smaller ones. This is because on the one hand, more population is concentrated in large ESE’s (i.e., a larger local market), and on the other hand, startups in these top-tier ecosystems may be able to reach markets beyond their home region.

The next overlapping elements are knowledge (Stam & van de Ven, 2019) and research and development, or R&D (ANDE, 2013). When it comes to knowledge creation, the percentage of gross domestic product invested in R&D – both at the private and public level – is usually a tell-tale sign of prosperity. Another spill-over of investment in R&D is the associated innovation, growth and job creation in those respective areas that manage to attract and keep this knowledge (Alesia, 2013). As pointed out by Fritsch and Noseleit (2013), region specific policies prevail over industry specific policies when it comes to government programs and measures that aim at stimulating new business creation and development. In Europe alone, INTERREG programs – financed by the European Regional Development Fund – was funding over 65 research and innovation projects at the time of writing this information (Interreg Europe, 2020). We may thus assume that smaller regional ecosystems – if successful at attracting R&D funding – should be able to compete with bigger players. The question of course that needs to be explored further is how regional ecosystems can maximize successful application for this type of funding, since typically around 25% of the projects tend to be approved (Interreg Europe, 2020).

The broader element of business support, as discussed by the ANDE (2013) model, could be best captured by three elements in Stam and van de Ven’s (2019) model: networks, intermediaries and leadership (N.I.L.). The basic idea is that for an ESE to be successful, singular leaders need to emerge, but they should strive for also serving – on top of own business interests – common interests and partnerships between private-private and public-private entities (Olberding, 2002). These entities would form the intermediaries and networks in an ecosystem and provide flow of information, knowledge, as well as labor and capital (Malecki, 1997). The motivation of various leaders and stakeholders to partner and network should be independent of ecosystem size; therefore, we do not consider this element a decisive factor between top-tier and smaller regional ecosystems.

The element of (entrepreneurial) culture is defined in both models as the entrepreneurial orientation and motivation that exists in a given society. However, its presence is as important as the degree to which it is appreciated, valued and trusted by said society. In other words, how common is it to start up a new business, how are successful entrepreneurships valued by society and how likely is it for people themselves to make the career choice of being an entrepreneur (Stam & van de Ven, 2019). There are several domains that can foster entrepreneurial culture, as pointed out by the ANDE model: media, government, schools, professional and social organizations.

With differences still observed between countries and cultures (Chohra, 2019; Middermann & Lubna, 2019); the good news is that economies can, in time, evolve from early stages of entrepreneurial culture to more advanced ones. For example, in a recent study on tech startups in India, Bala Subrahmanya (2017) analyzed the steady rise to “status and recognition” of Bangalore as the number one tech startup of India and third worldwide (per number of tech startups). Bangalore was able to achieve this feat mostly due to a massively supportive startup culture, which was in stark contrast to the more conservative Indian culture. However, too positive attitudes towards an excessively entrepreneurial culture can also backfire and break subsequent trust as experienced during the aftermath of the dot-com bubble in the late nineties and early 2000’s. Loss of market capitalization on tech stocks has accrued an estimated loss of 5 trillion US Dollars and sent the stock market in a free fall (Alden, 2005; Gaither & Chmielewski, 2006). In this sense, we consider culture an element that is important, yet difficult to predict as the differentiating factor between top-tier and regional ecosystems.

Last but not least, the element of finance, considered by many to be even the heart of the ecosystem (Cavallo et al., 2019). This element, discussed in both models (ANDE, 2013; Stam & van de Ven, 2019) seems to be defining when it comes to startup growth and survival. Common numbers associated with startup failure are staggering, around 90% chance of failure within 5 years, often due to funding issues (Patel, 2015). Financial resources can come from a plethora of sources: venture capital, grants, government or private loans, informal investors, “angels”, crowdfunding, or other forms of alternative finance (self-funding/bootstrapping, family, and friends). While all these different sources of securing financial capital have advantages and disadvantages (Wright, 2017), in general we may assert the extra struggle faced by small regional ecosystems in obtaining venture capital and private equity. This is because the financing structure tends to be less developed compared to top-tier ecosystems, especially when early-stage companies are looking for that initial bid to enter and stay in the race. A recent World Economic Forum article (Kazeem, 2019) reported a four-fold increase in startups receiving funding in Africa in 2018 compared to the year before. This tremendous jump in financing the startup sector reflects increased confidence by investors in the startup businesses in the region. A more comprehensive World Economic Forum study (2013) surveyed over 1,000 entrepreneurs across six continents. Their findings: a discrepancy between availability and perceived importance of funding and finance was reported by participants; availability being as high as 91% for Silicon Valley and below 50% in Asia and on the South American continent, while perceived importance was consistently rated by entrepreneurs in the top three elements that should be present in a healthy ESE.

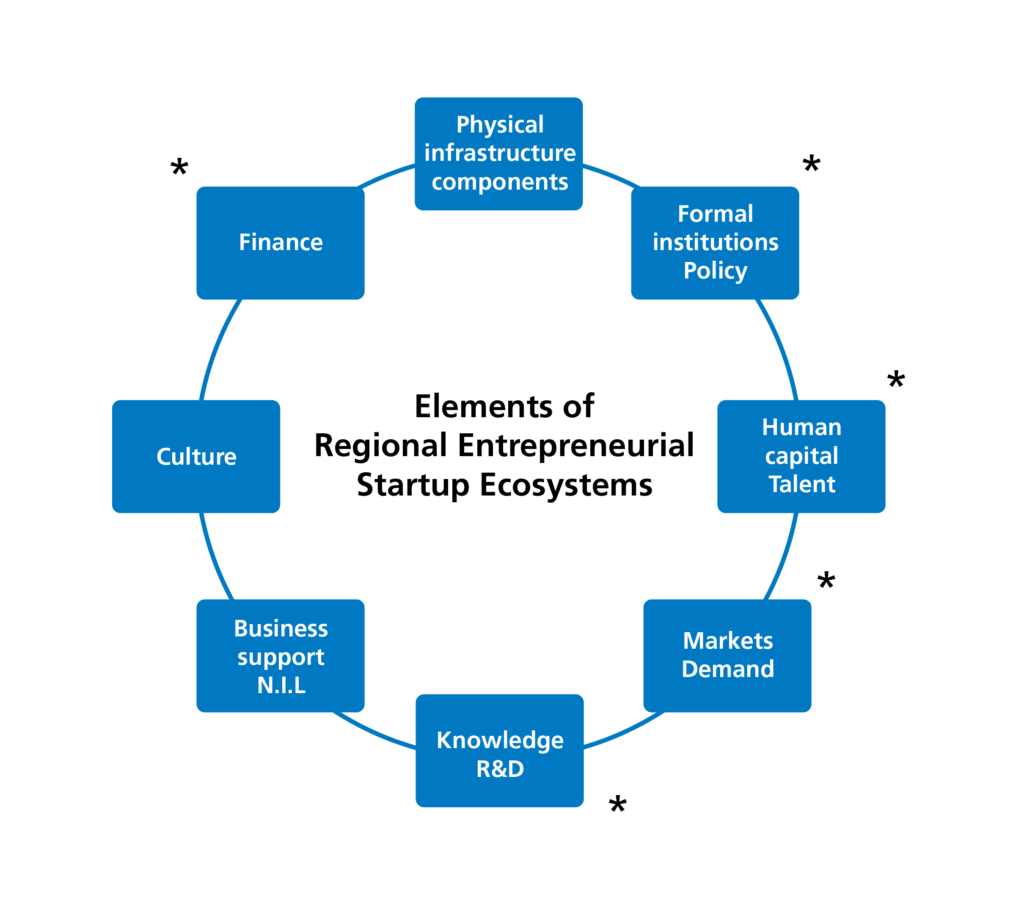

To sum up, we identified some commonly cited attributes and elements of ESE’s while trying – on the one hand – to identify overlap between elements, and – on the other hand – to point out where similarities and differences may exist between top-tier and regional ecosystems. Figure 3 presents a visual representation of these overlaps and differences discussed above.

Before moving on to our next discussion point, we would still need to emphasize the interconnectedness between (some) of these elements. As empirically validated by Stam and van de Ven (2019) with a large Dutch sample, these elements of the ESE are “mutually interdependent and co-evolve in a territory.” For example, these authors found culture, talent and support services to be correlated; knowledge/R&D and leadership to have strong links; and finally demand and physical infrastructure to be interdependent. With this being said, we also propose that these individual elements deserve further empirical attention with the purpose of identifying possible best practices for being a successful regional ecosystem.

3. Future Directions

The theoretical considerations put forth in this paper should be empirically tested. Specifically, the focus should be on smaller regional ecosystems (regional ESE’s), as opposed to top-tier, large and more successful ecosystems, such as Silicon Valley, Berlin and Tel Aviv. This is because most regions are small and cannot immediately call themselves top-tier when an ESE has been established. Organic growth takes time, sometimes up to many decades (Bala Subrahmanya, 2017), and is a careful synergy between public policy, a change in culture and favorable market forces.

To aid kick-off of empirically testing the elements discussed in this paper, we formulate the following propositions:

- Proposition 1: Physical infrastructure components do not have a defining impact on the success of regional ESE’s;

- Proposition 2: Formal institutions and policy do have a defining impact on the success of regional ESE’s;

- Proposition 3: Human capital and talent do have a defining impact on the success of regional ESE’s;

- Proposition 4: Markets and demand do have a defining impact on the success of regional ESE’s;

- Proposition 5: Knowledge and R&D do have a defining impact on the success of regional ESE’s;

- Proposition 6: Business support does not have a defining impact on the success of regional ESE’s;

- Proposition 7: Culture does not have a defining impact on the success of regional ESE’s;

- Proposition 8: Finance does have a defining impact on the success of regional ESE’s.

The current paper is theoretical in nature. We therefore call on researchers to start with empirically validating the eight attributes and elements put forth in this paper and – more importantly – do this in the context of regional ESE’s. Finally, research could also be done to explore the potential of neighboring regional ESE’s to combine resources and knowledge in order to evolve together into becoming a top-tier ESE.

References

- Alden, C. (2005). Looking back on the crash. Retrieved September 23, 2020, from https://www.theguardian.com/technology/2005/mar/10/newmedia.media.

- Aleisa, E. (2013). Start-up ecosystems project report. Retrieved from http:// www.janrecker.com/wp-content/uploads/ 2013/02/20130213_FinalReport_Start-up-Ecosystems.pdf.

- ANDE (2013). Aspen Network of Development Entrepreneurs. Retrieved from https:// assets.aspeninstitute.org/content/uploads/files/content/docs/pubs/FINAL%20Ecosystem%20Toolkit%20Draft_print%20version.pdf.

- Bakker, D. J. O. P., Blaga, M., & Wolf, A. (2019). Start-up perspectives: Start-up ecosystems in the Ems Dollart Region. Arbeitsmarkt Nord. ISBN: 978-90-5303-123-2.

- Bala Subrahmanya, M. H. (2017). How did Bangalore emerge as a global hub of tech start-ups in India? Entrepreneurial ecosystem – evolution, structure and role. Journal of Developmental Entrepreneurship, 22, 1750006 (22 pages). doi: 10.1142/S1084946717500066.

- Cavallo, A., Ghezzi, A., & Balocco, R. (2019). Entrepreneurial ecosystem research: present debates and future directions. International Entrepreneurship Management Journal, 15, 1291–1321. doi/org/10.1007/s11365-018-0526-3.

- Chohra, M. (2019). A critical review of the academic entrepreneurial ecosystem in developing countries: The case of Algeria. International Journal of Technology Management & Sustainable Development, 18, 243–259. doi: https://doi.org/10.1386/tmsd_00008_1.

- Corruption Perception Index (2020). Retrieved May, 23, from https://www.transparency.org.

- DW. Elon Musk threatens to move Tesla’s California factory over shutdown. Retrieved May 11, 2020, from https://www.dw.com/en/elon-musk-threatens-to-move-teslas-california-factory-over-shutdown/a-53384057.

- Ease of Doing Business. Retrieved May 23, 2020, from https:// www.doingbusiness.org/en/rankings.

- Fritsch, M., & Noseleit, F. (2013). Start-ups, long and short-term survivors and their contribution to employment growth. Journal of Evolutionary Economics, 23, 719–33.

- Gaither, C., & Chiemelewski, D. C. (2006). Fears of dot-com crash, version 2.0. Retrieved September 25, 2020, from https://www.latimes.com/archives/la-xpm-2006-jul-16-fi-overheat16-story.html.

- Halbe, H., & Koenraads, E. Ecosystem diagram. Retrieved April 23, 2020, from https://halbekoenraads.com/sid/.

- Hochberg, Y. V., & Fehder, D. C. (2015). Accelerators and ecosystems. Science, 348, 1202–1203.

- Interreg Europe. Retrieved May 15, 2020, from https://www.interregeurope.eu/about-us/facts-and-figures/.

- Kazeem, Y. (2019). Here’s why the African start-up scene is booming. Retrieved May 26, 2020, from https://www.weforum.org/agenda/2019/02/startup-investment-in-africa-jumped-to-record-levels-in-2018-as-later-stage-rounds-rose.

- Krajcik, V., & Formanek, I. (2015). Regional startup ecosystem. European Business & Management, 1, 14–18. doi: 10.11648/j.ebm.20150102.12.

- Malecki, E. J. (1997). Entrepreneurs, networks, and economic development: A review of recent research. In J. A. Katz (Ed.), Advances in entrepreneurship, firm emergence, and growth (pp. 57–118). JAI Press.

- Middermann, L., & Lubna, R. (2019). Cross-country differences in entrepreneurial internationalization tendencies: Evidence from Germany and Pakistan. Administrative Science, 9, 54. doi:10.3390/admsci9030054.

- Patel, N. (2015). 90% of startups fail: Here’s what you need to know about the 10%. Retrieved May 24, 2020, from https://www.forbes.com/sites/neilpatel/2015/01/16/90-of-startups-will-fail-heres-what-you-need-to-know-about-the-10/#4afd7c756679.

- Robbins, S. P., & Judge, T. A. (2019). Organizational Behavior (18th ed.). Pearson Education Limited.

- Roundy, P. T., Brockman, B. K., & Bradshaw, M. (2017). The resilience of entrepreneurial ecosystems. Journal of Business Venturing Insights, 8, 99–104.

- Olberding, J. C. (2002). Diving into the “third waves” of regional governance and economic development strategies: A study of regional partnerships for economic development in US metropolitan areas. Economic Development Quarterly, 16, 251–272.

- Stam, E., & Spigel, B. (2018). Entrepreneurial Ecosystems. In R. Blackburn, D. De Clercq, & J. Heinonen (Eds.), The Sage handbook of small business and entrepreneurship (pp. 407–422). SAGE.

- Stam, E., & van de Ven, A. (2019). Entrepreneurial ecosystem elements. Small Business Economics. doi.org/10.1007/s11187-019-00270-6.

- USC Marshall. Startup Index of Nations and Regions. Retrieved May 10, 2020, from https://www.marshall.usc.edu/faculty-research/centers-excellence/center-global-innovation/startup-index-nations-regions.

- World Economic Forum. (2013). Entrepreneurial ecosystems around the globe and company growth dynamics. Davos: World Economic Forum. Retrieved on May 26, 2020, from: http://www3.weforum.org/docs/WEF_EntrepreneurialEcosystems_Report_2013.pdf.

- Wright, F. (2017). How do entrepreneurs obtain financing? An evaluation of available options and how they fit into the current entrepreneurial ecosystem. Journal of Business and Finance Librarianship, 22, 190–200. doi:10.1080/08963568.2017.13372011.

Appendix